“Tariffs are taxes on consumers” is a popular mantra among critics of the Trump administration’s trade policies.

But it is hard to support based on price data released in the months since the Trump administration began imposing tariffs on imported steel, aluminum, and nearly half of goods imported from China.

In the October through December period alone, the U.S. Treasury collected $8 billion in tariffs, 83 percent more than it did a year earlier. But consumer prices have barely budged. The Department of Labor’s consumer price index was just 1.9 percent higher in December than it was a year ago and on a month-t0-month basis, prices actually fell.

Excluding volatile food and energy doesn’t change the picture very much because core inflation was also very low. Core CPI climbed just 0.2 percent for the month, exactly as it had a month earlier, and is up 2.2 percent from a year ago. That is in-line with November’s 2.2 percent, October’s 2.1 percent and September’s 2.2 percent 12-month increases. The Federal Reserve says it targets inflation of 2 percent.

If tariffs were acting as taxes on consumers prices would be higher. At the very least, prices on items subject to tariffs would be higher.

Yet prices of most items subject to the metals and China tariffs have either declined or advanced on pace with or slower than inflation and wages. In other words, prices for most tariff impacted items fell in inflation-adjusted terms. Only major appliance prices are clearly showing evidence of tariff pressure.

Steel and Aluminum Consumer Goods

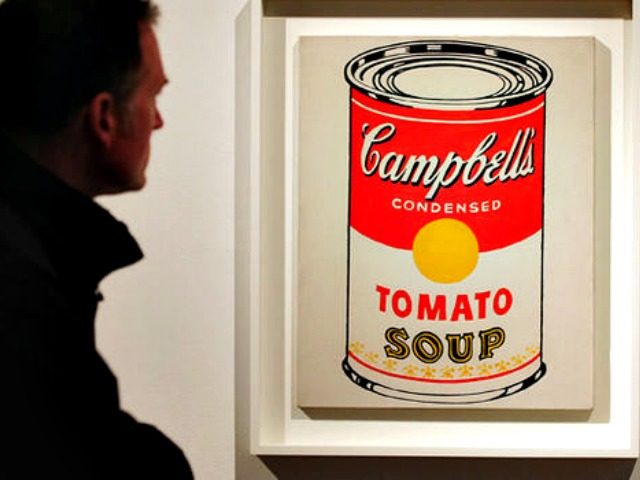

Take the price of soup and beer. Breitbart News has been closely following the prices of soup and beer ever since Commerce Secretary Wilbur Ross confronted critics of tariffs back in March on CNBC while holding up a can of Budweiser and a can of Campbell’s soup. The prices of these items, Ross argued, would hardly be affected at all by the 10 percent tariff on aluminum. Critics had argued that the rising the price of the metal would win up pinching consumers by raising prices in the grocery aisle.

The price of soup rose 2.5 percent in December, a large month over month increase. But this is a very volatile category on a monthly basis, thanks in part to seasonal adjustments. In the prior two months, soup prices fell 1.7 percent and rose 1.4 percent. Without adjustments, soup prices rose just 1.6 percent from November. But more importantly, prices of soup at home–largely canned soup–are down 1.4 percent compared with a year ago. No tariff pressure there.

One reason soup may have jumped in December is that vegetable prices were up sharply. Fresh vegetable prices were up 2.6 percent for the month and 4.6 percent compared with a year ago. This pushed up prices on canned fruits and vegetables, another category of consumer goods that was widely predicted to see prices rise because of increased aluminum costs, by 1.5 percent. That reversed two months of monthly declined. Compared with a year ago, this category’s prices are up 3.1 percent. But, as with soup, this appears to be driven not by the price of cans but what is in them.

The price of beer consumed at home was unchanged for the month and is up just 1.9 percent compared with a year ago. This is not all cans, of course. But since cans and bottles are close substitutes, the overall price level of beer at home is the relevant category. (And the only one the government tracks.) If canned beer were rising but bottled beer were falling by equivalent amounts, keeping the overall price category unchanged, consumers would be no worse off.

The upward pricing pressure on beer consumed in bars and restaurants, which was notable because the price of beer kegs has reportedly gone up because of the aluminum tariffs, is no longer showing up. Beer consumed prices outside out the home are up just 2.2 percent compared with a year ago, a deceleration from the 2.6 percent recoreded in November. For the month, the price of beer consumed outside of the home was flat.

Car and truck prices also show no signs of tariff-driven inflation. Prices of new cars fell a seasonally adjusted 0.2 percent in December and are up just 0.2 percent for the year. That’s another deceleration in price gains, down from a 0.8 percent annual gain in November and a 1.2 percent annual gain October. The price of new trucks was flat in December, November, and fell after in both October and September. Compared with a year ago, truck prices are down 0.7 percent, a substantial acceleration of deflation from the 0.1 percent annual decline recorded in November.

Consumer Technology and Other Imports

Many of the categories of consumer goods that are largely manufactured abroad also saw steep declines.

Tools and hardware continue to defy the “tariffs are taxes on consumers” narrative. Prices on these rose 1.6 percent in December, following a 0.1 percent decline in November and a 0.4 percent decline in October. Compared with a year ago, tools and hardware prices are up just 2 percent.

The cost of televisions fell again in December, dropping by a seasonally adjusted 0.8 percent. This is the fifth consecutive monthly decline for televisions. Compared with a year ago, television prices are off 11 percent. The steep drop may reflect sluggishness in the housing market since a lot of television sales accompany home purchases.

The price of personal computers rose 1.4 percent in December, reversing two months of declines. Compared with a year ago, they are down 3 percent. Phone prices fell again, for at least the fourth consecutive month, and are now down 11.2 percent compared with a year ago.

Earlier this year, prices of major appliances were up sharply but this was largely driven by the steep climb in the price of laundry equipment, which in turn was driven by a specific anti-dumping tariff imposed in January of last year that were intended to drive up the price from artificially depressed levels. Those washing machine gains, however, are tapering. Prices of laundry equipment were up just 13.2 percent compared with a year earlier, down from an annual gain of 15.5 percent in November.

And so, not surprisingly, the broader major appliance category is no longer seeing higher prices. On a monthly basis, prices fell 0.3 percent. Compared with a year ago, prices are up just 4.7 percent.

Made in China 2018

The tariffs on Chinese-made goods also do not seem to have had much of an effect on consumer prices. Initially, these applied to $50 billion of imports from China and were largely focused on technology goods. In late September, however, the China tariffs were broadened to cover $250 billion and a wider array of consumer goods.

The prices of furniture and bedding, one of the largest categories of China-made imports, rose just 0.5 percent in December and are up just 1.7 percent annually. Toys, another big import category, saw prices rose 0.8 percent in December. For the year, toy prices are down 9.0 percent. Sports equipment prices rose 0.7 percent, the second monthly increase after several months of declining prices. Compared with a year ago, however, sports equipment prices are down 2.7 percent.

Clothing and shoe prices were unchanged on a seasonally adjusted basis in December and are down 0.1 percent compared with a year ago.

Once again, the consumer price data has largely demolished the notion that tariffs are squeezing consumers. That does not mean that prices will remain low or tariffs will never push prices up. It just demonstrates that they have not yet done so.

Coupled with the news that the U.S. Treasury collected $8 billion in tariffs from October through December, however, the low prices may indicate that the burden of tariffs are falling on foreign producers. This can happen when export prices fall in reaction to tariffs, either because foreign manufacturers seek to maintain market share but discounting their goods or because foreign currencies decline against the dollar. So prices may not go up at all for U.S. consumers.

COMMENTS

Please let us know if you're having issues with commenting.